Leading companies innovate. Through innovation, they create value to their customers, shareholders and the markets in which they operate. With innovation, new internal capabilities are built, a shared sense of corporate pride develops, and unique organizational cultures emerge, reinforcing expertise and competitive advantage. Establishing an innovation culture catalyzes and initiates these virtuous cycles.

This article discusses a novel approach to the strategic selection and execution of innovation, utilizing corporate (or guided) venture builders for petrochemical organizations in the face of uncertainly.

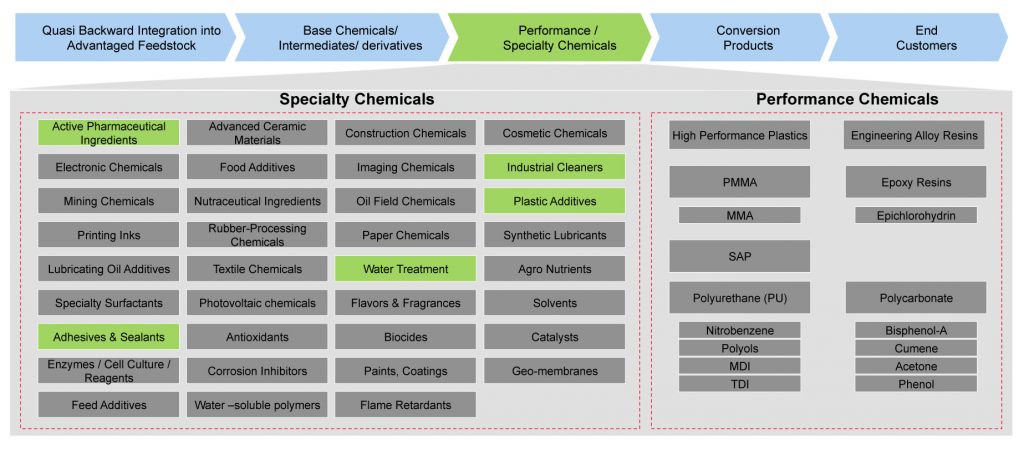

In our analysis, we investigate product market segments in the petrochemical sector and highlight areas of performance specialty chemicals where the venture builder operational model can be used to drive investment success. Review of selected petrochemical leaders shows continued investment activity. Can these investments be further optimized?

In terms of innovation outcomes, the effects of the current economic downturn in the petrochemical sector are asymmetric – they differ across and within its sectors. Value chains closer to customer demands are more likely to innovate than those more distant. Innovators during economic downturns create industry leaders during recoveries. Many companies are breaking ground on innovation investments – pursuing new opportunities in diverse areas such as new product development, Industry 4.0, corporate entrepreneurship, and ecosystem collaboration. Before COVID-19, petrochemical industry diversification was strong, with an increase in excess of 25% in new products during 2018 -2019. However, constraints during downturns focus vision on cost-cutting and limits the appetite for new investment.

Logic and Approach

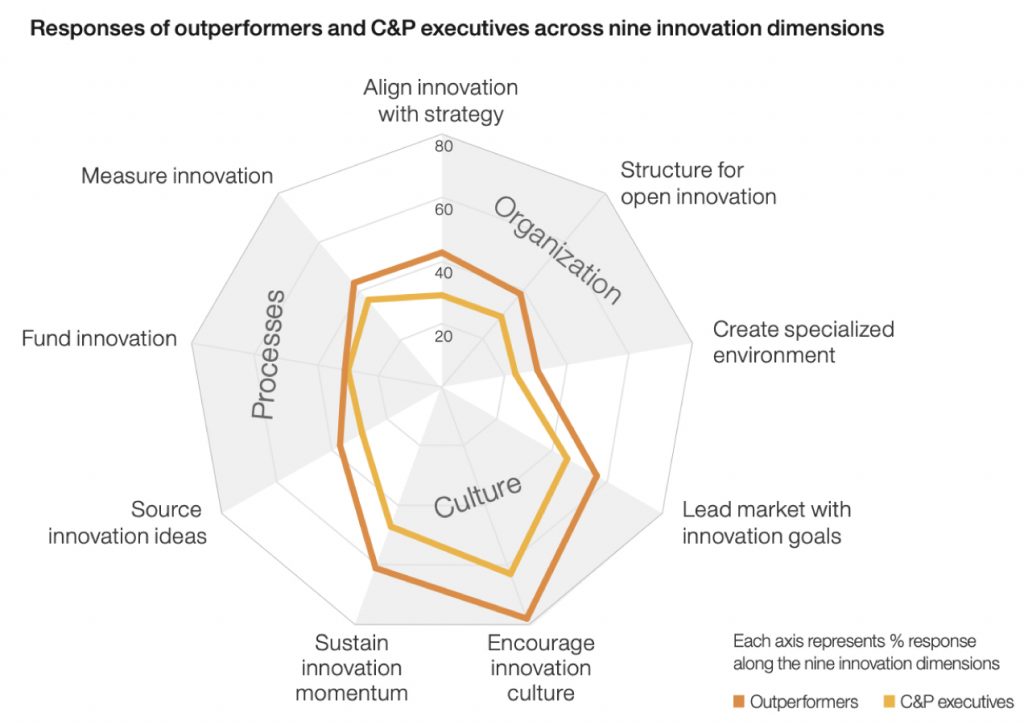

Research conducted by the IBM Institute of Business Value identified that across nine dimensions Chemical and Petroleum (C&P) executives tended to underperform innovation leaders. Except for one area – funding innovation. In the eyes of its executives, the industry spends comparable amounts on innovation but extracts less value from its investments.

Traditional Approach

Traditional methods of corporate innovation are via internal initiatives – projects and programs. Cultural change being sought through training, change and ideation campaigns. Amassing capabilities by these methods requires time and is inward-looking – limiting innovation’s scope. To accelerate innovation and include external perspectives, many companies have started building innovation garages (also known as studios).

New Thinking and Approach to Solutions

A garage establishes a set of process for companies and professional service firms to collaborate in the development and scaling of prototype products or services. Depending on the company’s strategy, garage operators assign resources with required skills. For innovations in the petrochemical industry, this expertise typically leverages artificial intelligence, blockchain, robotics, automation or similar technologies. The participants in a garage are limited to the organization setting up the garage and the service provider. Garage developments are typically digitizations. They are enhancements of existing processes – not new business and revenue models derived through digitalization[2]. Garage commercial dynamics are human resources services agreements driven by consulting time costs. Garage service providers have little skin in the game. Operators often bundle their preferred technologies as part of the package – further limiting their independence. In effect, garages deliver by leasing expertise and technology with the hope of creating new products, knowledge and corporate startup cultures in the process.

On the surface, corporate venture builders operate procedurally like garages. They oversee the ideation-execution-operation life cycle, but their business models differ in three important ways. Firstly, they are not limited to a single organization’s experts but instead rely on placing a corporation within an ecosystem of startups and independent subject matter experts. Different startups can be engaged in parallel, leveraging different technologies and approaches at the same time. Secondly, the commercial model between venture builder partners is not solely based on consulting fees but can include a mix of fees, equity, market access and other resources – venture builders and their partners have skin in the game. Thirdly, rather than just focusing on creating a prototype – the venture builder’s goal is to create an entirely new line of business. Corporations assign resources to have the right but not the obligation to acquire a stake in a startup’s innovations – in the process, the organization’s innovation cultures advance. A corporate venture builder is more option than lease.

Focus and filter for strategic innovation

To determine an innovation investment’s attractiveness and organizational capability fit, we define business drivers and innovation capabilities which align with the current business environment and support organizational tactical and strategic initiatives. These business drivers cover seven dimensions: new market value; industrial and government co-creation potential; location advantages; market structure advantages; profitability, flexibility and growth potential; and investment requirements. Capabilities are assessed based on four dimensions: strategic ambitions; culture and knowledge; location and infrastructure; and technology. By weighting and scoring both drivers and capabilities, we identify four areas of strategic focus for innovation investment in the current context of performance and specialty products.

The time is now – build your garage

Petrochemical organizations long-term growth strategies need to leverage innovation to create operational and financial sustainability. The Red Queen hypothesis suggests that when value propositions and competitive positioning remain stagnant, one is left behind. Like organisms, organizations must continuously adjust and improve their capabilities to survive.

Innovation expands capability horizons. The petrochemical industry is undergoing another period of significant shifts. The confluence of the next industrial revolution, an ever-changing global marketplace and rising customer expectations are creating a perfect storm – simultaneous pushing and pulling the industry.