By: James Brimm is an Advisor to the CEO of SIPCHEM & Kirk-Dale McDowall-Rose is an advisor to the Office of the Group CEO of – the Saudi Tadawul Group

Crisis yields opportunity. The Petrochemical industry, over recent years, has been faced with the challenge of initiating continuous improvement programs and pursuing Shareholder Value. However, one cannot improve or measure that which cannot be observed. The successful organization seeks value – but what exactly is value, and how is it created?

This article explores the notion of value, the importance of intelligence, and an approach to maximizing value when engaging with professional service firms.

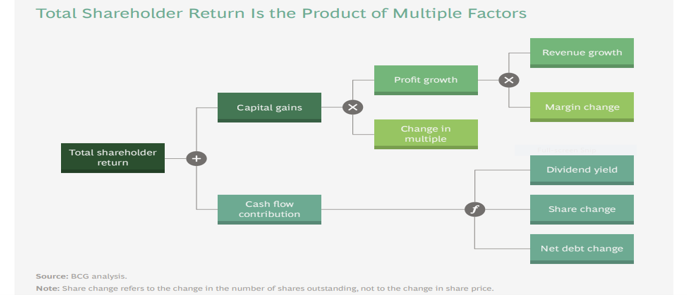

Petrochemical players face unique challenges, threats, and opportunities. Focused, specialty companies have typically invested in searching for value through research and development, while multi-specialty companies have invested more in capital expenditures. The underlying business models of these businesses differ, as do the methods by which they seek value. A precise understanding of value creation and delivery across different business models is needed. In our research, we represent value using Total Shareholder Return (TSR). TSR does not account for Pareto efficiencies (e.g., to account for broader environmental considerations) between organizations and the wider society; however, it provides a robust framework for conceptualizing value within an organization.

Top and Bottom-line Impact – TSR Perspective

Financial health can be observed at both the top and bottom lines. Topline performance highlights the company’s capabilities in sales generation – it does not factor in operating efficiencies. Whereas bottom line performance highlights how efficiently the company can manage its operational costs and other expenses. Topline growth is the company’s increase in revenue or gross sales over a defined period. It is used to indicate a business’s financial strength and potential for future growth. Bottom-line growth is referred to as the net profit, which comes at the bottom of the income statement

Petrochemical players can simultaneously enhance the top and bottom-line value by increasing revenues and reducing operating costs. Petrochemical companies thus derive value from both top and bottom-line initiatives, and both contribute to shareholder returns. The higher the TSR, the more significant are capital gains for shareholders, stock price appreciation for employees and owners, and the more robust the platform for future success.

The petrochemical industry’s business problems are increasingly complex. However, reducing complexity and mitigating risk exposure is possible if an organization develops capabilities that turn information into intelligence, understand the root causes of issues, and enhance decision making to drive successful outcomes. These capabilities are critical to bridging the value chasm. The ability to perform root cause analysis and test hypotheses is the initial step towards optimal resource assignment and value creation. A lack of these skills creates an overreliance on third-party advisors, increases costs, and will not necessarily bridge the value chasm.

The nebulous nature of defining strategic initiatives increases the risk of value and resource misalignment. At the tactical end of the spectrum, risks are still present but more predictable. However, when focusing on both top and bottom-line growth, petrochemical players better mitigate the predictable and unpredictable risk factors by focusing on short and long-term value realization targets.

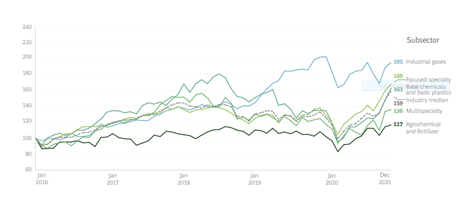

The chart below shows Total Shareholder Return growth between 2016 – 2020. As you can see, growth varied among subsectors.

Considering TSR and value contribution in time series returns. We further considered if an initiative requires external advice, ideally the desired outcome, should be identified prior to engaging advisors and consistently measured across the idea-implementation-introspection life cycle. In a 2013 interview with The Economist, the famous Harvard Business School professor Clayton Christensen mused that a perennial problem in professional services was the inability of clients to define problem statements, select vendors and measure outcomes. It is important to have a clear definition of value, hold advisors accountable and track value after an initiative’s conclusion. Commonly used operating practices make doing so a challenge – since strategy, procurement, project management, and performance management are in most organizations disparate processes. All too often, a unified understanding of value is lost along the way. This loss of value can be felt most acutely in working capital and CAPEX intensive industries – such as the petrochemical sector.

Navigating the value chasm requires a four-pronged approach. Petrochemical companies should:

- Map out a TSR value tree across their operations. Doing so will help identify value levers that form the basis for hypothesis testing. Hypotheses and problem statements should be tested and refined thoroughly by leveraging expertise within the organization and amongst trusted external advisors.

- Identify (based on a hypothesis) value levers and clear issue statements. This will be used for selecting external advisors or for commencing internal initiatives. Should external advisors be needed, companies should seek to conduct an extensive sourcing analysis of possible advisors – beyond traditional incumbents.

- Integrate the idea-implementation-introspection activities by connecting strategy, management reporting, procurement processes, vendor selection, project delivery and benefit realization processes within an organization.

- Institutionalize independent value realization follow-ups to monitor the extent to which outcomes have been realized, focusing on top and bottom-line impacts.

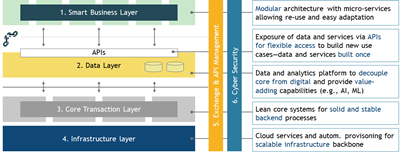

Technology plays a pivotal role in enabling these processes. A best-in-class Data and Digital Platform (DDP) is critical in building technology capabilities and data insight fundaments and helping avoid the risks of information obesity (information with few insights or intelligence). DDPs allow management to sort through mountains of information to arrive at the intelligence and improve business decisions, which focus organizations on their targets. DDPs can help organizations identify the root cause of their business problems in a flexible, agile way.

In addition to data solutions, several global marketplaces of service providers have gained traction. These marketplaces can be leveraged to support the sourcing and evaluation of new advisors.

In conclusion:

Petrochemical players today need to analyze, simulate, backcast, and forecast hypotheses; whilst maintaining an eye on what intelligence is required and where value is created (or destroyed). Information obesity can be misleading – giving the impression of insights, when there are none. Utilizing intelligence and understanding value levers that drive the realization of value is essential—for example, contrasting strategies such as paying an attractive dividend versus gaining new market entry and strong commercial awards. All of which could be considered to contribute to greater TSR albeit in the longer term. In analyzing value, the questions one asks are often more important than answers one gains. In addition, when engaging with external advisory support, a clear internal understanding of what type of value creation is sought is a must to ensure implementation success.