By James Brimm, CEO Advisor, SIPCHEM, Shelly Trench, Managing Director and Partner, BCG, and Hasan Alkabeer, Partner, BCG

The future is more uncertain than ever before. For the petrochemical and chemical sector, the economic environment through 2020 driven by the demand shock caused by the COVID-19 crisis and supply-side of oil price decline had caused value chains to slow and even shutdown. By many indications, we can expect a long and drawn out recovery over the next 12-24 months as depressed global economic activity recovers. However, there are three areas of immediate priority where players can focus to build resilience and catalyze change in their business models and ways of working, which are:

- Identify value patterns and sustain value creation – Delivering expected Total Shareholder Return targets by rapidly adjusting portfolios, products and operations to market dynamics

- Build the bionic organization – Evolving the fundamental process with employees, suppliers, and customers to embrace digital capabilities at the core of petrochemical operations

- Enable the future workforce – Rapidly upskilling and reskilling employees on an

ongoing basis

The importance of being able to take agile action can be highlighted through 2020, where we observed a notable difference between the top 10% of performers experiencing an average increase of 50% in the stock price in the first five months of 2020, and the bottom 10% experienced an average decrease of 25% in stock price. Why such a large spread? It is partly driven by specific chemicals sub-sector market dynamics, some that are hit harder than others, however, the rest is shaped by the purposeful actions those top companies have taken over the past decades in shaping their business models and ways of working in dynamic environments. The moment is now to move forward and invest in the next generation of strategic actions to shape and prepare petrochemical organizations to lead the new reality.

Identify value patterns and sustain value creation

As a first step, petrochemical companies should consider reprioritizing their strategic agenda, projects, and product portfolio to ensure they are aligned with the new market realities. Examples of this include strategic M&A opportunities – which can be especially effective in industrial clusters where there is an opportunity to integrate infrastructure and services and realize cost synergies. It could also include the option to sell off, mothball, or decommission unprofitable assets. We have seen this for example with LyondellBasell acquiring 50% of Sasol’s Lake Charles Chemical Project while it was in distress in 2020.

On a more operational level, petrochemical players need to sharpen their ability to take tactical, strategic decisions in dynamically managing production plans in response to volatile market conditions. Optimizing for end to end contribution margin of products based on scenario planning to maximize profits and minimize losses in response to the market and operating environment. Not only will this require the right analytical tools and capabilities, but equally as important is the right decision steering mechanisms that will allow the company leadership to make agile and bold decisions in a timely manner, as windows for such opportunities will be short in duration.

Operational excellence will accelerate in focus for many players, driven by the adoption of digital tools supporting further cost competitiveness and margin optimization. This will expand into areas of operational resilience in inventory and logistics as well as management of supply risk for materials. We can also expect a more rigorous focus on liquidity management, given the expected volatility in market dynamics.

We also expect that companies will invest in new models to maintain and gain market share and competitiveness, including innovative market access strategies, advanced pricing mechanisms, introducing new business activities (e.g., Trading) and digital opportunities.

Finally, to truly sustain value creation for the long-term, petrochemical players will need to address and embrace sustainability, climate change, and the circular economy by establishing a dedicated taskforce to understand how those opportunities and risk factors into their overarching strategic roadmap. Having a well articulated sustainability strategy will be table-stakes for players seeking to compete in the long term.

Build the bionic organization

The current crisis has compressed the timeline to our digital future from a period of five to 10 years into a period of approximately one to three years. This has created an opportunity for companies to accelerate their digital agendas, with surveys in 2020 showing 83% of companies planning to accelerate digital transformations post crisis.

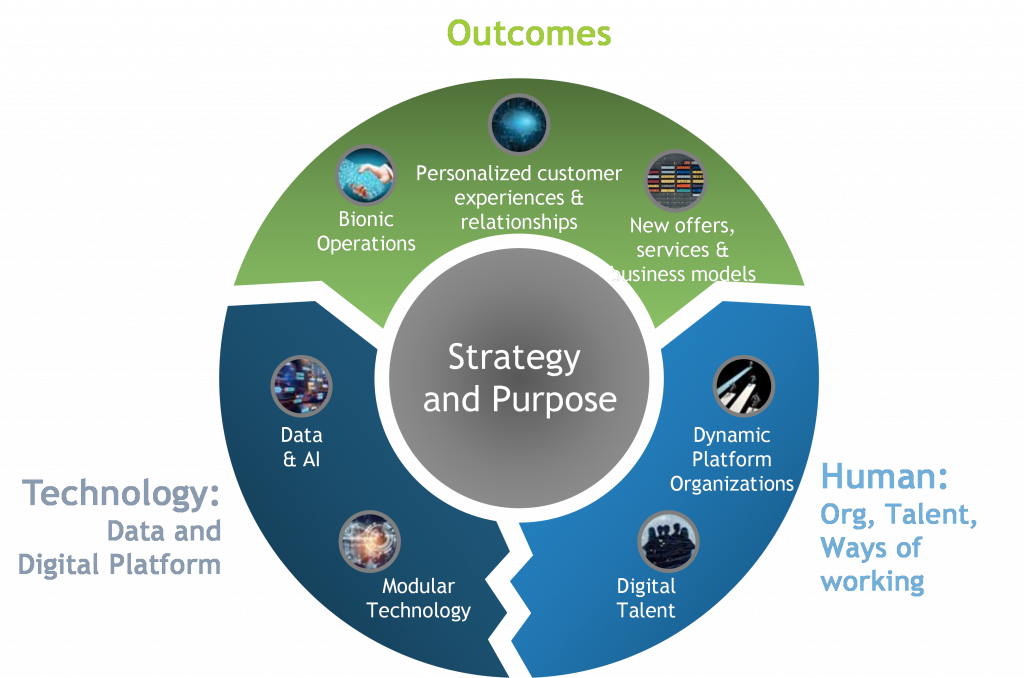

However, these digital agendas are far more complex than traditional IT projects and demand that they include not only new digital technologies but also a digitally savvy organization. In the future, the human and the tech will converge in the future to what we term the bionic organization.

Building a bionic organization means designing the technology and the human organization around one another to realize transformation in operation outcomes, customer experiences and relationships, and new offers and businesses. A holistic view on migrating to a digital organization. Exhibit 1 below illustrates the key elements of a bionic organization leveraging technology: data and digital platforms, human: organization, talent and ways of working, and outcomes to deliver of the strategy and purpose.

Bionic companies have shown to outperform their less digitally-savvy peers in dimensions of earnings, innovation and value by up to 1.5-1.8x. This is achieved through investment in technology with more than 15% of OPEX driven into tech in digital, having dedicated staff with digital profiles that work on digital topics, and scaling up digital pilots to enterprise-level solutions.

Historically, however, the overall digital revolution has not been fully leveraged in the chemical and petrochemical industry, perhaps reflecting the conservative nature of this industry. We find the industry lagging behind in maturity relative to other industries such as financial institutions. That said, the post crisis environment has accelerated that trajectory and is driving maturity of the industry from ‘digital starters’ to ‘digital performers’. There are several examples of chemical and petrochemical players that have invested in digital across the entire value chain, and we expect this to continue rapidly.

Succeeding along the digital transformation journey will require companies to invest along the dimensions shown in Exhibit 1. where the level of preparedness along those dimensions has been demonstrated to be a key success factor between organization that have succeeded in their transformations and those that have not. This involves companies being focused to harness data and digital platforms to deliver on objectives and effectively generate insights for the organization. Human and technology skills will reinforce each other and establish a more flexible, adaptive, data-driven, and digital organization. Technological application, in this case, becomes the basis of core value-creating processes, with the use of data and analytics transforming decisions across the business and support functions, bringing with it a dramatic shift in skill sets.

Enable the future workforce

This skill sets shift demands the upskilling of staff at an unprecedented scale and speed while requiring the establishment of an effective, sustained learning ecosystem. After all, in the future, not only will companies be competing for talent, but they will also compete at the pace of learning and how fast they can absorb change and build capabilities.

In a bionic company context, digital learning will need to take place at all levels, with senior leaders needing a digital vision to lead the organization and senior managers needing digital fundamentals to build a digitalization agenda. Beyond that, there is great importance in skills such as solid communication and analytical skills, complex problem-solving skills, and leadership.

Some steps to achieve these goals can include (a) creating a strategic workforce plan

and complementing it with strategic skills mapping, (b) launching targeted upskilling programs and offering new ways of learning, (c) establishing an enterprise-wide upskilling culture and (d) extending upskilling efforts to the wider society to invest in upskilling of future recruits.

Successfully achieving this will also be predicated on an organization with foundations in a performance-driven culture and accountability ecosystem.

Conclusion

The new normal is upon us, and the chemical and petrochemical industry will need to rise to the challenge of delivering on the large change opportunity ahead. The crisis has driven us to re-think our operating models and take big steps forward, but as they say ‘never waste a crisis’ – instead, accelerate out of it with decisive and bold strategic moves.